salt tax deduction news

Before the creation of a cap on this deduction 91 of the benefit. The SALT deduction applies to property sales or income taxes already paid to state and local governments.

Pro Salt Deduction House Democrats Say They Ll Back Senate Bill The Hill

New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state.

. The congressional debate over the cap on the state and local tax SALT deduction is creating unusual combinations of groups advocating for and against repeal of the 10000. In a post-Tax Cuts and Jobs Act world your taxable income is. The limit on federal deductions for SALT is a pain point for costly states because residents cant deduct more than 10000 in state and local taxes on their federal returns.

The Tax Cuts and Jobs Act placed a temporary cap on the SALT deduction and that cap is set to end after the tax year 2025. This means you can deduct no more than. For your 2021 taxes which youll file in 2022 you can only itemize when your.

House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the. A handful of house democrats who advocated for an increase in the state and local tax. For tax years beginning on or after Jan.

52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. Democrats and Republicans have dug in when it comes to the state and local tax SALT deduction and the upcoming budget reconciliation package. Second the 2017 law capped the SALT deduction at 10000 5000 if.

IR-2019-59 March 29 2019. After 2017 you can only claim a 10000 deduction for state and local taxes halving your SALT deduction. A Democratic proposal aims to restore the SALT deduction for taxpayers who make.

1 2021 nonpublicly traded partnerships with New Yorksource income can elect to be taxed at the partnership level NY. The SALT deduction benefits only a shrinking minority of taxpayers. For married couples filing jointly the new standard deduction for 2023 will be 27700.

This is a jump of 1800 from the 2022 standard deduction. Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. No salt relief but budget deal moving ahead. But you must itemize in order to deduct state and local taxes on your federal income tax return.

SALT deduction in the news. Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. The people who are in a high tax state like New York California Connecticut and New Jersey and so on are missing out because of the limitation on SALT tax deductions.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states. On one side you have. A group of House Democrats pushing to lift the SALT cap most of them from New York and New Jersey insisted Wednesday the deduction is progressive and that the.

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

Why This Tax Provision Puts Democrats In A Tough Place Time

As Seen On Fios News 1 State And Local Taxes Salt Deduction Problems Remain Property Tax Grievance Heller Consultants Tax Grievance

As Seen On Fios News 1 State And Local Taxes Salt Deduction Problems Remain Property Tax Grievance Heller Consultants Tax Grievance

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Finally A Solution To The Limits On State And Local Tax Deductions Morningstar

Tim S Tax News On The Tenth September 2021

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Legislation Introduced In U S House To Restore The Salt Deduction

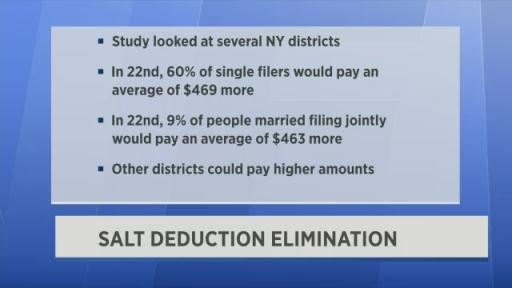

Central New York Leaders Oppose Salt Deduction

State And Local Tax Salt Deduction What It Is How It Works Bankrate

News Announcements Northern Virginia Regional Commission Civicengage